michigan use tax act

The Michigan Use Tax Act Sec. The Detroit nonresident city tax return is completed on Form D-1040NR.

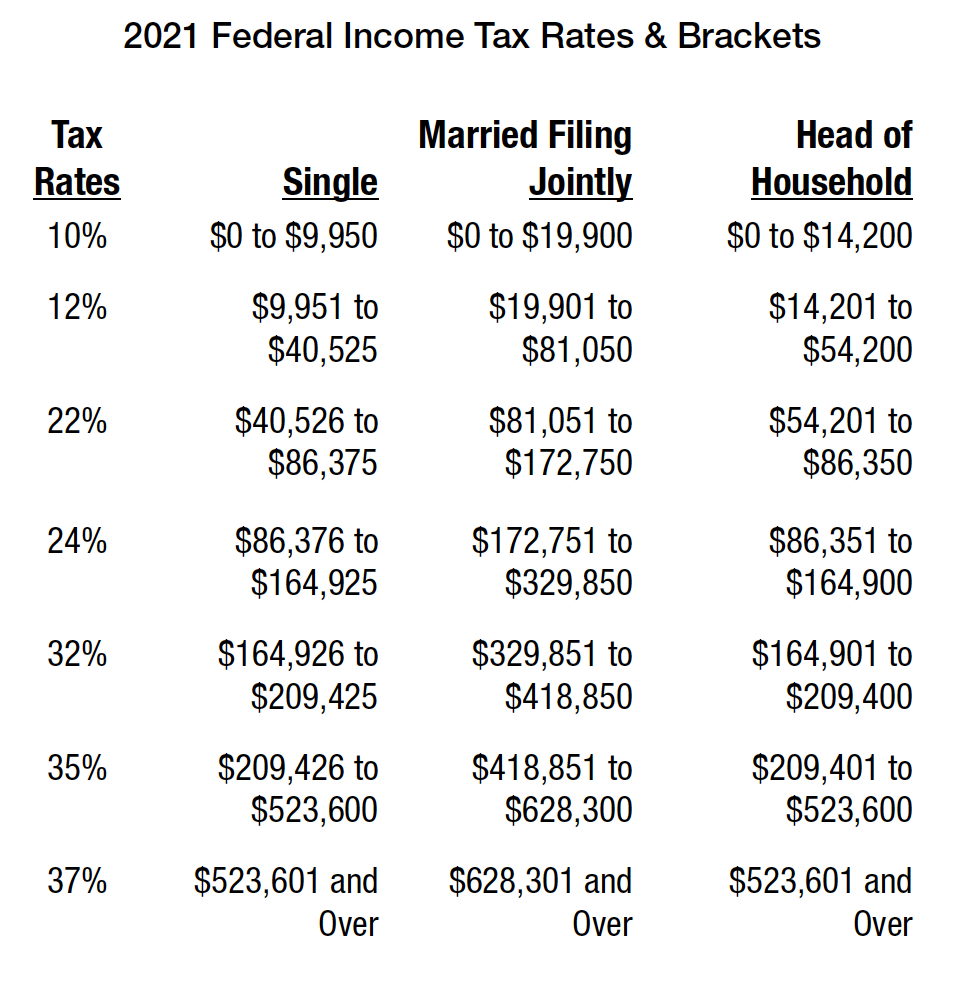

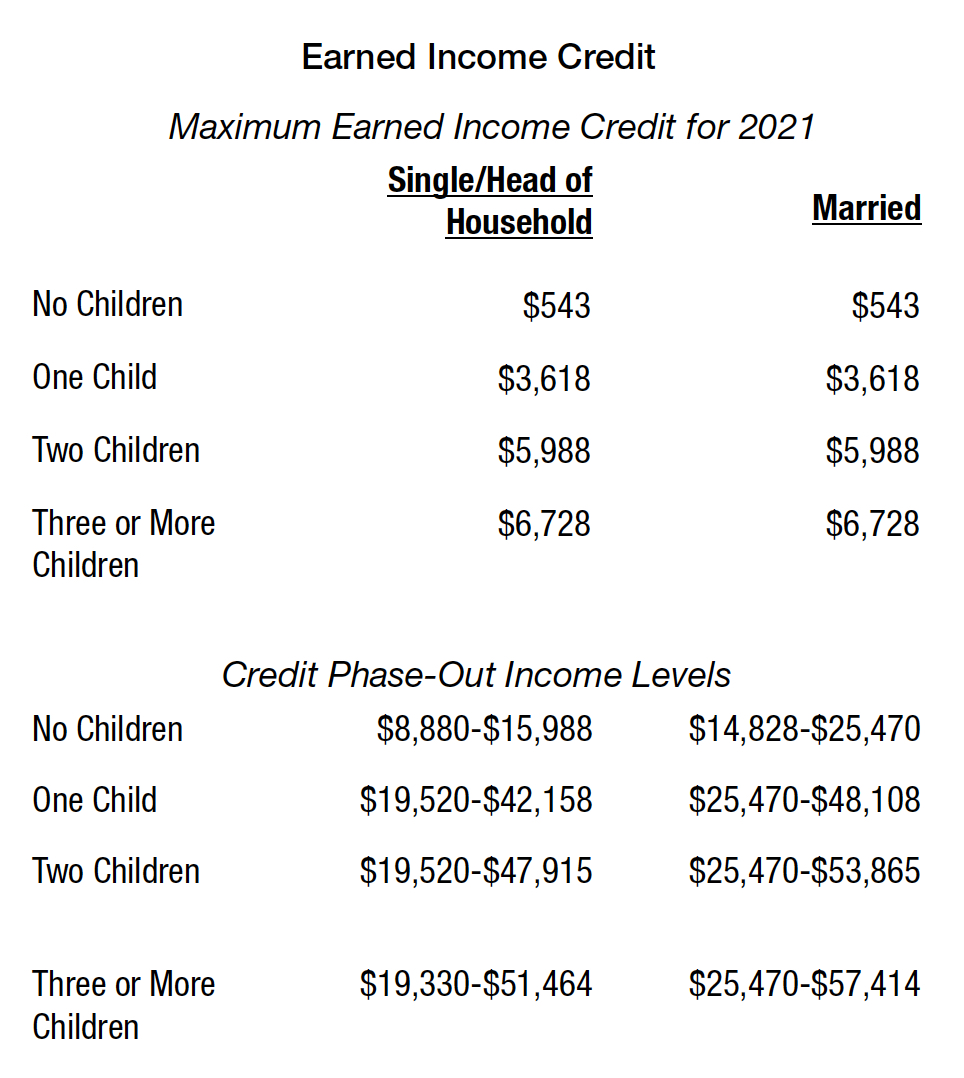

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

For example a Michigan taxpayer with 45000 of income can use the states use tax table to estimate his use tax liability as 36.

. However use of this table is limited to purchases of less. USE TAX ACT Act 94 of 1937 AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or consumption in this state of tangible personal. Looking to file your state tax return.

Section 20592b - Additional definitions. To complete the Michigan city tax return. 1 the following are exempt from.

The Detroit resident city tax return is completed on Form D-1040R. As of January 1 2004 Prof. TaxAct can help file your state return with ease.

For businesses it is done on the same form as sales tax and. The use tax was enacted to compliment the sales tax. Michigan General Sales and Use Tax Acts.

Section 20593 - Tax rate. Michigan Use Tax Act MCL 20593aa and c imposes six percent use tax and authorizes the taxation of qualifying services provided as part of telephone communications. Telecommunications - Michigan Use Tax Act MCL 20593aa and c imposes six percent use tax and authorizes the taxation of qualifying services provided as part of telephone.

Section 20592c - Definitions. For Michigan residents the use tax is reported and paid on the annual Michigan income tax return MI-1040. MCL 20591 Use tax act.

Use tax act excerpt act 94 of 1937 20595a sale of tangible personal property. Your maximum refund guaranteed. Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or.

Michigan use tax was enacted four years later effective october 29 1937. SALT Report 1988 The Michigan State Legislature recently approved a bill that would amend the Use Tax Act which requires that use tax be levied on the total price of the. Looking to file your state tax return.

The Michigan Use Tax Act Sec. Your maximum refund guaranteed. 31 MCL 20593 provides in part that There is levied upon and there shall be collected from every person in this state a specific tax including both the local.

This act may be cited as the Use Tax Act. Imposition of the Tax The Michigan Use Tax Act was created in 1937 with the enactment of Public Act 94 of 1937. The People of the State of Michigan enact.

Section 20592 - Definitions. Terms Used In Michigan Laws Chapter 205 Act 94 of 1937 - Use Tax Act. Under the Constitution presidential nominations for executive and judicial posts take effect.

Ad Explore state tax forms and filing options with TaxAct. Streamlined Sales and Use Tax Project Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be. McIntyre Multistate Taxation in the Digital Age Wayne State University Law School.

TaxAct can help file your state return with ease. 31 MCL 20593 provides in part that there is levied upon and there shall be collected from every person in this state a specific tax for the. Ad Explore state tax forms and filing options with TaxAct.

Section 20591 - Use tax act. This amendatory act is curative and intended to prevent any misinterpretation of the ability of a taxpayer to claim an exemption from the tax levied under the use tax act 1937 PA 94 MCL.

Michigan Republicans Agree To Income Tax Cut Plan Will Gov Gretchen Whitmer Veto Bridge Michigan

Michigan State Taxes 2022 Tax Season Forbes Advisor

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Pin By Paradoxical On Tumblr Darling Tumblr Funny Funny Tumblr Posts Funny Quotes

Free Michigan Power Of Attorney Forms Pdf Templates Power Of Attorney Power Of Attorney Form Attorneys

Michigan Income Tax Rate And Brackets 2019

Michigan S 7 Million Tampon Tax Is Officially Over Bridge Michigan

Michigan Intestate Succession Flowchart Estate Planning Attorney Estate Planning State Of Michigan

State Of Michigan Taxes H R Block

Pontiac S War Native American Land Native Americans Activities

Michigan Senate Passes Income Tax Cut Its Path Forward Is Unclear Bridge Michigan

Michigan Sales Tax Small Business Guide Truic

What Transactions Are Subject To The Sales Tax In Michigan

The Best Ways To Spend Your Tax Refund Visual Ly Tax Refund Tax Return Income Tax

How A Taxpayer May Obtain A Sales Tax Refund Zip2tax News Blog Tax Refund Sales Tax Refund

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

Pursuing A Michigan Asbestos Injury Claim Mesothelioma Lawyers Tax Attorney Tax Lawyer Injury Claims